Generally, this credit will increase the amount of your tax refund or decrease the amount of the tax you owe.Įligible individuals who did not receive an Economic Impact Payment this year – either the first or the second payment – will be able to claim it when they file their 2020 taxes in 2021. It is a tax credit against your 2020 income tax. The Recovery Rebate Credit is authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the COVID-related Tax Relief Act. Learn more about the 2020 Recovery Rebate Credit here.

#Irs stimulus status full#

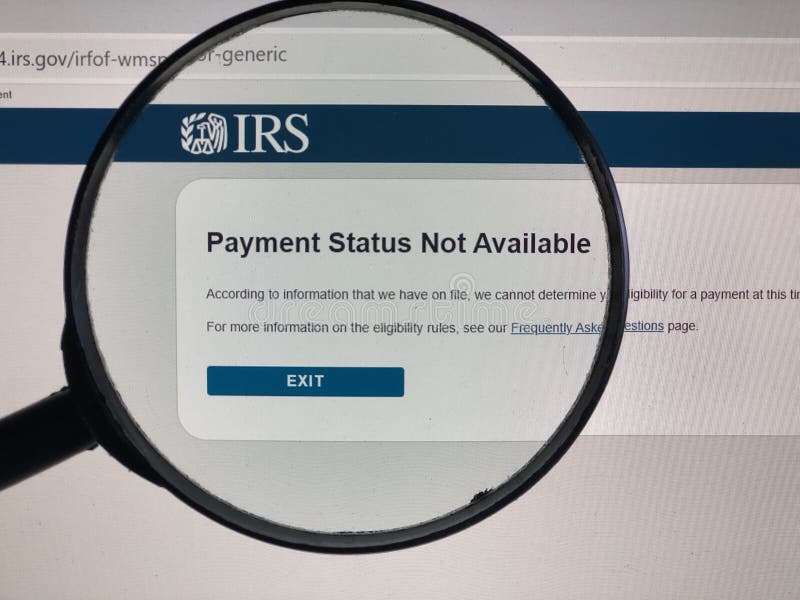

If you did not receive the full amount of the first two payments, you may be eligible to claim the 2020 Recovery Rebate Credit on your 2020 tax return. If you have questions about the Get My Payment tool, visit the IRS Get My Payment FAQ page.ĭidn’t get the full First and Second Payments? You can check when and how your payment was sent with the Get My Payment tool. The Third Economic Impact Payments in accordance with the American Rescue Plan Act of 2021 are being distributed by the IRS.

How do I get the Third Economic Impact Payment?

The IRS also launched a new hotline to help answer FAQs about stimulus payments, which you can reach at 80. If you have questions, you should visit this FAQ page, which is regularly updated and has helpful info about eligibility, calculating your payment, and more. If you are unsure about the eligibility and contents of each EIP, you can read more about them at these webpages:įor the IRS homepage for all Economic Impact Payments click here. Information on Economic Impact Payment #1, #2, and #3ĬOVID relief packages passed by Congress provided three rounds of stimulus payments.

0 kommentar(er)

0 kommentar(er)